Reminder that I am still a novice at investing and these are all my personal experiences

I recommend reading the articles I linked throughout my post to better understand and make your own informed choices

I talked about my experience as a beginner investor back in 2023 at 24 years old. Check out that post as I talk about my experience and steps I took.

It has been about two years since I started investing, and I honestly have continued learning, but remained investing in the same areas that I originally invested in.

This past year in 2024 has been less than productive year for me as I kept all my investments and just continued to let it grow.

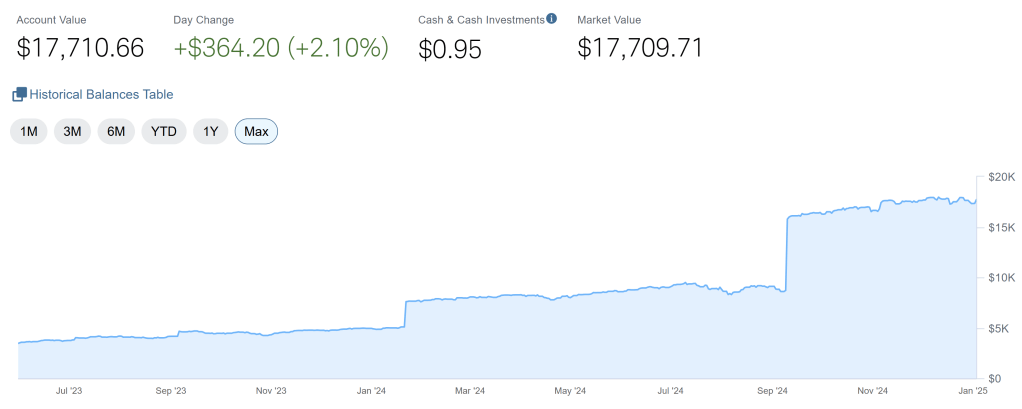

If you remember, I opened a Roth IRA, which has a contribution limit of $7,000 for 2024, and so I made that contribution for this past year and invested in the companies and stocks that I believed in. As you’ll see below, I made my Roth IRA contribution around September 2024. This was the only contribution and investment I made this past year.

You can learn more about ROTH IRA from more reputable and informational sources here:

The world of investment continues to be a learning lesson to me as I believe in the saying that “time in market beats timing the market.” I will continue to leave my investments for the long term and hope for the best.

I still think that investing is the best decision that I have made financially so far.

TD Ameritrade –> Charles Schwab

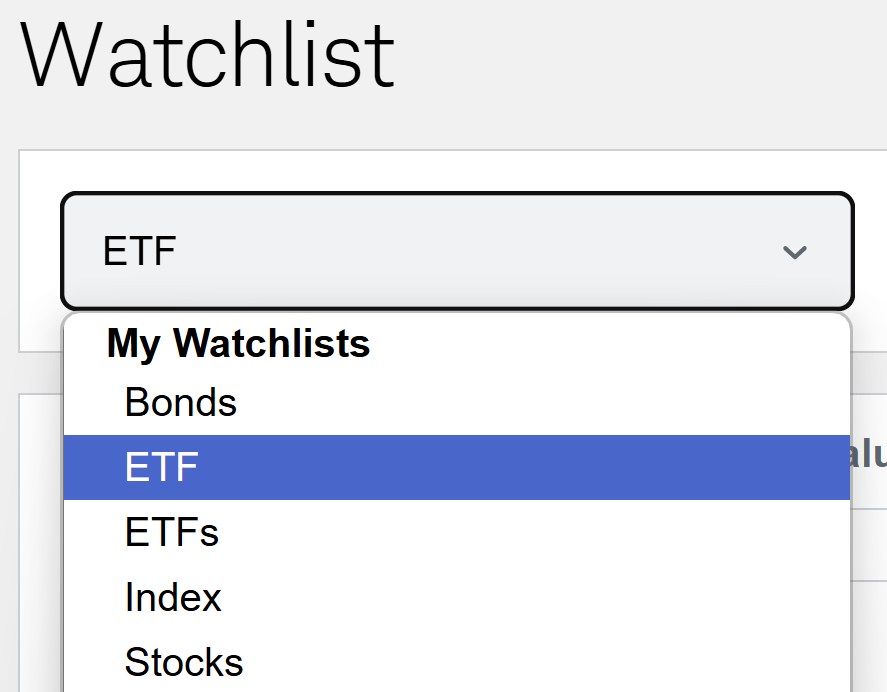

Well to start, the original brokerage that I started with, TD Ameritrade, was officially acquired by Charles Schwab, so I was moved to their platform. So far it has been a good platform with some easier mechanisms to maneuver than Ameritrade was, but lacked some parts of Ameritrade that I really liked, like the view of ALL your watchlist at once. Charles Schwab’s function requires that you click on specific watchlist. Below is a screenshot of what you see if you have multiple watchlists that you have to click on to view each of the company you put in each list.

While it was originally inefficient to me, I got used to it in no time, and have not had a hard time transitioning.

There are a lot of resources that Charles Schwab does provide that you can learn more from as well: Charles Schwab Insights & Education

So what does my stats look like now that it has been about 2 years since I started contributing.

Below are just some statistics of what was gained when I was transferred to Charles and Schwab in May 2023 until December 2024. This is NOT including what I contributed, so overall, my account gained $3,562.28 in this time. This is investment money that was gained in my portfolio.

In my previous post, just 6 months after I began investing, I had gained $462.08. It takes time and patience, and seeing the change in how much my portfolio is netting is very exciting.

I hope that you can start your investing journey as well, read more about some steps I took in my original post here.

Continue following along in my investment journey, and I hope it motivates you to start no matter your age as well!

Below is a brief overview of the steps I outlined in my original post:

1. What Type of Investment Account?

There are 4 main types of investment accounts, that you can learn more about them below from the experts:

- 4 Types of Investment Accounts You Should Know – NerdWallet

- Types Of Investment Accounts – Forbes Advisor

- Roth IRA vs. Traditional IRA: Key Differences (investopedia.com)

- Roth vs. Traditional IRA: Which Is Right For You? – NerdWallet

- Traditional and Roth IRAs | Internal Revenue Service (irs.gov)

- Roth IRA vs traditional IRA | Comparing IRAs | Fidelity

- Roth IRA vs Traditional IRA – Forbes Advisor

2. Finding a Broker

I recommend reading up on different articles for the most cohesive broker that you want. Below are some readings that I think can help you decide as I usually review between these four websites:

- Best Online Brokers and Trading Platforms of 2023 (investopedia.com)

- 11 Best Online Brokers for Stock Trading of June 2023 – NerdWallet

- Best Online Brokers Of June 2023 – Forbes Advisor

- Best Online Stock Brokers In June 2023 | Bankrate

3. Initial Investment

I wanted to start off with a bang, so I sent a starting investment amount of $1,000. This is just the process of transferring money from my bank into my investment account. Once it was there, it was in a cash investment with the broker. If left alone in there, it grows cent by cent daily. However, if you don’t have $1,000 to start putting in, I highly recommend reading from these individuals on how to start with just $5:

- 3 Easy Ways to Invest with Just $5 (creditdonkey.com)

- Here’s How Much You Could Make If You Invested $5 a Day | The Motley Fool

4. Learning the Broker System

This basically means to spread my money around in different pockets and types of investment (stocks, ETFs, Mutual Funds, Bonds, etc.).

Below are just some of my ways to learn about the different types of investment to spread your money in:

- Investing Explained: Types of Investments and How To Get Started (investopedia.com)

- Types of Investments – NerdWallet

- 10 Types of Investments and How They Work – SmartAsset

- 5 Tips for Diversifying Your Portfolio (investopedia.com)

- 6 Ways To Diversify Your Investing Portfolio | Bankrate

- 3 Tips for a Diversified Portfolio | The Motley Fool

5. Read Around From the Experts

For me, I pulled from the experts, I read multiple experts’ take on which companies to invest in, their credentials, potentials, and other tips they had. So I took away my own list of strong companies that I think will be around for a long time based on how society is moving, ones that survived through the rough market crashes stronger than ever, and history of returns.

6. Start Investing

I started investing in the other companies that I researched, and by the end of February 2023, my portfolio was spread out.

I read through these articles and chose the best one for me:

- The 3 Best S&P 500 Index Funds for 2023 | The Motley Fool

- Top S&P 500 Index Funds (investopedia.com)

- The Best S&P 500 Index Funds Of June 2023 – Forbes Advisor

- 3 Best S&P 500 Index Funds of 2023 | Money

7. Mistakes will Happen (Healthy Checking Habit)

One fateful day, not even 5 days into buying stocks and investing, I sold my Amazon stock on February 8, 2023. I had originally bought it for $112.68, and I had seen its price drop to $102.19, which was below what I originally bought it for, and thought it was a good idea to sell and buy at this low price so that when it increased in the future, I would earn money.

Wrong thought.

I immediately regretted it when I bought it, and told myself I would never do that again.

So I would recommend choosing a healthy checking habit that works for you. If you are like me, and wants to keep control of everything and see your progress, work with yourself on what will work. If you are perfectly okay not seeing it for a month until the next investment month, then that is perfectly fine as well.

8. Monthly Transfers

I personally did not consistently make monthly transfers for the past couple of months because I had transferred about $3,000 the very first month of investing.

But invest what you can for your financial situation. Definitely do not over invest what you don’t have because you still need to keep yourself afloat in your daily life as well.

Leave a comment