Have you ever wanted to start investing but don’t know where to start?

The world of investment is a mystery to those that have never tried it. It was to me as well. It was discouraged by my parents and others adults because you could lose money if you made bad investment decisions. As such, I never went looking it up, until now.

January 2023 has been a great start for me. I was working steadily in my new job, fresh 3 months in. I had received good work feedback and was very invested in being at my position for the foreseeable future. However, as I became more stable, I became more unstable and wanted to start trying something new, learn more about why in my very first post about why I started my blog.

Heads up, that I am new at investing! I am a beginner!

I think investing is the best decision that I have ever made financially so far.

I started investing in January 2023, and have not even completed one year of investing yet, so I am definitely not the expert if you were looking for one.

I am learning and reading more about investing, and learning from the experts who have been around successfully investing. However, if you want to, I definitely welcome you to join me on my journey into investing, and maybe even help motivate you to take a stab at investing.

How did I get the idea to start investing at 24 with no knowledge or experience?

Honestly, a new year, new job, new resolutions, and a positive outlook as the COVID pandemic calmed down. My first full-time job 3 months fresh with good feedback on my performance so far, feeling accomplished and proud of how far I’ve come, and then the freed up space after work. As mentioned earlier and in my first post, the start of January 2023 was more stable, but I felt unsatisfied and unmotivated with my time usage outside of work. So I started reading about my finances, and then I became curious about retirement savings planning. I read through pages and pages of articles from different resources. One article that really pointed me toward investing was Investopedia’s article (no affiliation) about why you should start saving for retirement in your 20s.

By the second week of January 2023, I had read and watched multiple successful investors give advice on how to start as a beginner for retirement, and into investing.

And so I took the first big step on Thursday, January 12, 2023.

Below are the steps I took to investing:

1. What Type of Investment Account?

There are 4 main types of investment accounts, that you can learn more about them below from the experts:

- 4 Types of Investment Accounts You Should Know – NerdWallet

- Types Of Investment Accounts – Forbes Advisor

For my first investment, I was interested in starting a retirement account so the rest of my steps will be for a retirement account, but I think my steps can be generalized to the other accounts as well since my steps are more informational on how I went about starting my investment.

I had originally heard about the different types of retirement plans like 401k, 457b, and 403b. I have 457b and 403b with my workplace in collaboration with Fidelity. However, I wanted more choices for investment, and learned about the two main types of IRA accounts, Traditional and Roth IRA. I would recommend reading about the differences between the two and choosing which one you preferred (for retirement) or from the above different types of investment accounts (NerdWallet or Forbes Advisor). Below are just some sites that laid out the differences in retirement accounts in an easy to digest way for me when I was first looking (no affiliation).

- Roth IRA vs. Traditional IRA: Key Differences (investopedia.com)

- Roth vs. Traditional IRA: Which Is Right For You? – NerdWallet

- Traditional and Roth IRAs | Internal Revenue Service (irs.gov)

- Roth IRA vs traditional IRA | Comparing IRAs | Fidelity

- Roth IRA vs Traditional IRA – Forbes Advisor

I chose to open a Roth IRA, because I liked the flexibility in its ability to grow tax free into retirement without a required withdrawal by a certain age and because I expect that my income level will be higher near retirement so the benefit of being taxed now at a lower tax income bracket than in the future at a higher tax bracket was more appealing to me. But as I said, definitely read up and make your decision based on what you want of different investment accounts.

2. Finding a Broker

Next, after I decided which IRA was better for me, I looked around for what are the top brokers for beginners with easy usage. As you guessed, I also recommend reading up on different articles for the most cohesive broker that you want. Below are some readings that I think can help you decide as I usually review between these four websites:

- Best Online Brokers and Trading Platforms of 2023 (investopedia.com)

- 11 Best Online Brokers for Stock Trading of June 2023 – NerdWallet

- Best Online Brokers Of June 2023 – Forbes Advisor

- Best Online Stock Brokers In June 2023 | Bankrate

Around January 2023, the one that I saw with the most easy to use, beginner friendly, and free to open account was TD Ameritrade, so I created an account for a Roth IRA with them.

3. Initial Investment

Once I created my account, I was really motivated to start investing. Although I have read that anyone can start with just $5 or $10 or $20 in investing, I wanted to start off with a bang, so I sent a starting investment amount of $1,000. This is just the process of transferring money from my bank into my investment account. Once it was there, it was in a cash investment with the broker. If left alone in there, it grows cent by cent daily. However, if you don’t have $1,000 to start putting in, I highly recommend reading from these individuals on how to start with just $5:

- 3 Easy Ways to Invest with Just $5 (creditdonkey.com)

- Here’s How Much You Could Make If You Invested $5 a Day | The Motley Fool

4. Learning the Broker System

Everybody always tells you open an account and then start investing, but really, this step is super important for me. I had to learn the system of TD Ameritrade first before I could do anything else because I was scared I would make a mistake. I learned where to find the trades, I learned what ticker symbols were, how to find them if there was a company name I wanted to look at to potentially invest in, and more. Thankfully TD Ameritrade’s format was simple to learn, but a couple of days in, I was really just trying to understand what different types of investment were available and understanding how to diversify my portfolio. This basically means to spread my money around in different pockets and types of investment (stocks, ETFs, Mutual Funds, Bonds, etc.).

Below are just some of my ways to learn about the different types of investment to spread your money in:

- Investing Explained: Types of Investments and How To Get Started (investopedia.com)

- Types of Investments – NerdWallet

- 10 Types of Investments and How They Work – SmartAsset

- 5 Tips for Diversifying Your Portfolio (investopedia.com)

- 6 Ways To Diversify Your Investing Portfolio | Bankrate

- 3 Tips for a Diversified Portfolio | The Motley Fool

Overall, the really important step to me before investing was to understand the system of the broker that you were working with, really just get used to the layout and where to look for information.

5. Read Around From the Experts

This next step that I took was to really make sure that I understood what companies I was investing my money into. Some people tell you that if you really believe in one company, then put your money there. Others give you more of a guidance on how to pick the investment that you will be investing in. And I say do all of that.

For me, I pulled from the experts, I read multiple experts’ take on which companies to invest in, their credentials, potentials, and other tips they had. So I took away my own list of strong companies that I think will be around for a long time based on how society is moving, ones that survived through the rough market crashes stronger than ever, and history of returns.

After I made the list for myself, it was time to research, research, and research. I read about each companies, how they have been doing for the past decade. I have heard about the S&P 500 as it has been around for ages and have shown good performance returns in terms of money back on investment by looking at the top 500 largest companies in the United States, and thought it was something that could invested in, but found that I cannot invest in it directly. I learned I can invest in index funds that followed the S&P 500 so I did.

I cannot give my own opinion on what to invest in since I am a beginner myself, however, I can say with confidence, from everything I’ve read, that putting at least a bit of your money into investing in an index fund that follows the S&P 500 would be a smart idea. Because index funds have a multitude of companies it follows, you would in a way be diversifying your investments that way if you don’t know specific companies to buy stocks in yet.

*You may notice that a lot of my links have Investopedia (no affiliation), they were a main source that I went to learn about investing, along with other sources as well, so I definitely recommend finding a source that you trust in*

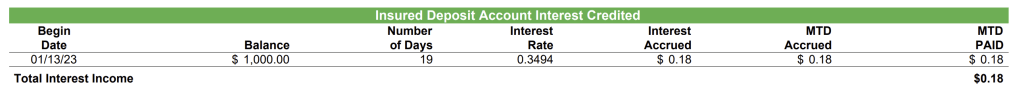

Don’t be in a rush to invest your money. I left my $1,000 in the cash section of TD Ameritrade without investing it at all for about 19 days as I learned the system and read around more, and gained 18 cents, hahaha.

However, once you have read around and picked out a few companies that you have researched yourself by looking at their returns over the years and other factors that you decide is important for investing in, then you can start investing.

6. Start Investing

I believe the very first company I invested in was Google on February 2, 2023, actually BOTH Google (GOOG and GOOGL). I had to learn how to actually trade, by selecting the correct ticker symbol, buying, and choosing how much I would want to buy it for (based on how much it was at the time). Then I invested in Apple and Microsoft the same day as well, also because I have seen its success in society and I believe that it will be around for the long run.

By this time, I was looking at my bank and saw some money just sitting there, earning my less than 0.001% from my bank each year, so I transferred another $2,000 into my investment account. I had money saved up and were gaining me pennies in banks, so I figured I might as well take the risk (that’s the benefit of being young and starting). If you do not have that option, I definitely don’t recommend doing what I did and do it by what you are capable of.

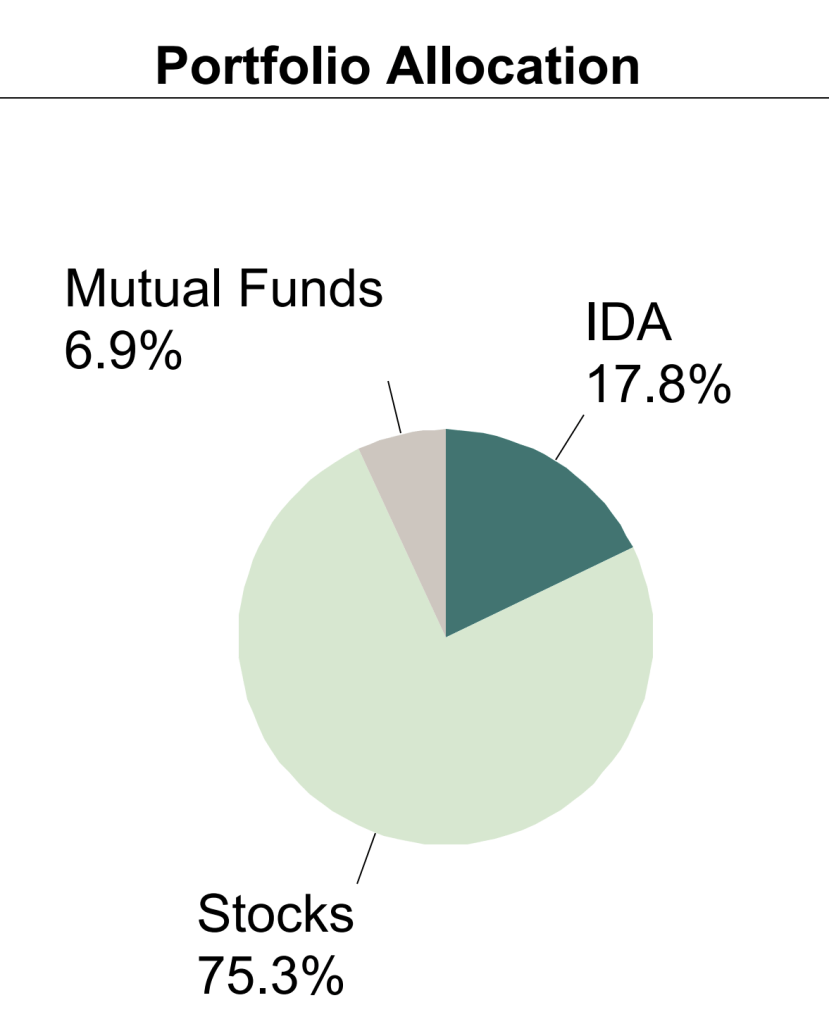

I started investing in the other companies that I researched, and by the end of February 2023, my portfolio was spread out. As you’ll see on my portfolio below, 75.3% of it is in stocks. For younger individuals, I heard that it was okay to be a bit riskier and invest in stocks (but remember with more risk comes more rewards, but also more risk have more danger of loss). So it depends on how risky you want to be with you money allocation.

Also, when you have invested, there is sometimes an option for dividend reinvestment, which is when the company you invested in gives you portion of their earnings back, and you either want that as money to your account or for it to be reinvested back to buy more shares of the company. I always select this choice, because that puts the dividend money back into investing more for the long run. Also, since I was just starting out, the dividend I got back was in cents anyway.

You can also read more about what dividends are below:

- What Is a Dividend and How Do They Work? – NerdWallet

- Stock Dividend: What It Is and How It Works, With Example (investopedia.com)

- Dividend Reinvestment: Should I Do It? | The Motley Fool

- https://www.investopedia.com/terms/r/reinvestment.asp

- Reinvest dividends to stretch your investment dollars | Vanguard

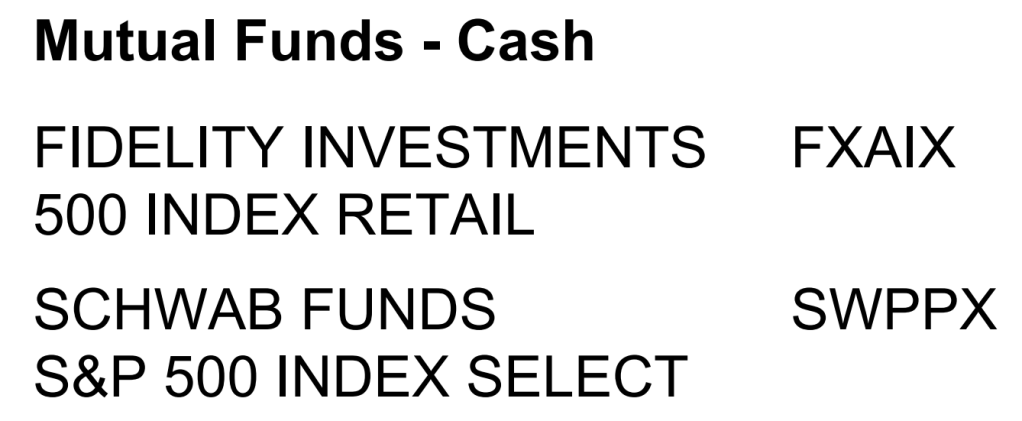

Further on my investment, the index funds that I chose that followed the S&P 500 were Fidelity Investment 500 Index Retail (FXAIX) and Schwab Funds S&P 500 Index Select (SWPPX). I honestly could have just chosen one, but I decided why not go for both.

There was a commission fee for Fidelity, which meant that I had to pay an additional fee (about $40) along with what I wanted to buy the mutual fund for it, and Schwab did not have a commission fee. However, there are other mutual funds that you can invest in, so I definitely recommend going to read and find which one best suits your needs based on its status and what you can afford.

I read through these articles and chose the best one for me:

- The 3 Best S&P 500 Index Funds for 2023 | The Motley Fool

- Top S&P 500 Index Funds (investopedia.com)

- The Best S&P 500 Index Funds Of June 2023 – Forbes Advisor

- 3 Best S&P 500 Index Funds of 2023 | Money

7. Mistakes will Happen (Healthy Checking Habit)

Once you have made your first investment, and have used most of your money, the only thing left is to keep watch of it. I say this as a warning, but do not become obsessed with checking your investment daily. Since I was so excited about investing, and had put a large amount at the beginning, for a beginner, I was checking my account every single hour of every single day since I started. I saw my initial investment go down more than it went up, meaning I lost money on my stocks, and I was worried I made the wrong investments.

And so one fateful day, not even 5 days into buying stocks and investing, I sold my Amazon stock on February 8, 2023. I had originally bought it for $112.68, and I had seen its price drop to $102.19, which was below what I originally bought it for, and thought it was a good idea to sell and buy at this low price so that when it increased in the future, I would earn money.

Wrong thought.

What I did not realize at that time was that I had bought it when it was at a higher price, so when I sold it at the lower price, thinking I can re-buy it for that lower price for it to grow later, I had actually lost money (about $10). This meant that for me to actually earn money from Amazon’s stock. I would have to make $10 more than what I sold it for to break even at $0 before considering it as a gain.

I immediately regretted it when I bought it, and told myself I would never do that again.

However, I stayed obsessed with watching the numbers rise and drop for another month and a half, until I somehow finally processed that it takes time for growth, and that I needed to be patient. I read multiple articles on how often I should check my account, and most said once a month. However, knowing how curious I am and would not be able to just check once a month, I have made it into a healthy stage of checking it just once or twice a week for no longer than 15-30 minutes.

So I would recommend choosing a healthy checking habit that works for you. If you are like me, and wants to keep control of everything and see your progress, work with yourself on what will work. If you are perfectly okay not seeing it for a month until the next investment month, then that is perfectly fine as well.

8. Monthly Transfers

On that note of checking it monthly, investing involves monthly transfer (if you can). Monthly transfer is something that should take place, where you transfer a bit of what leftover money you have or how much you can afford to put into your account each month to invest into any of your stocks, funds, or new companies.

I personally did not consistently make monthly transfers for the past couple of months because I had transferred about $3,000 the very first month of investing. I added in an extra $300 by the end of May 2023. For Roth IRA for 2023, we can make a maximum contribution of $6,500 (IRS IRA Contribution Limit Page). However, other investment accounts do not have that limit, mine does because it is a retirement account.

So far, I have invested $3,300 on TD Ameritrade, so that by the end of the year, I can contribute another $3,200 for the 2023 year. This way, I can maximize by contribution to grow the maximum that it can from what I have invested in.

But invest what you can for your financial situation. Definitely do not over invest what you don’t have because you still need to keep yourself afloat in your daily life as well.

9. How Much Have My Investment Grown?

Since I have only invested $3,300, anything more than that would be a gain and anything less than that would be a loss. Remembering my mistake from selling Amazon, I lost about $10, so I would have about $3,290 invested by estimate. I currently have $3,752.08 as of today June 14, 2023, meaning that I have earned about $462.08 in just the 6 months of investing.

It is not a lot and there is sure to be ups and down, but it’s growth is more than I have ever made in one year with my money at the bank (I made $10 last year with more than my invested amount right now). And it is a small, but sure and steady growth.

And that is how I got into investing (for retirement) at the age of 24. I have only just begun, and I am still continuing to learn, and I assure you that you can start (at any age) as well. Take it from me, who was just as scared but excited to start.

10. How Do I Know It will Grow?

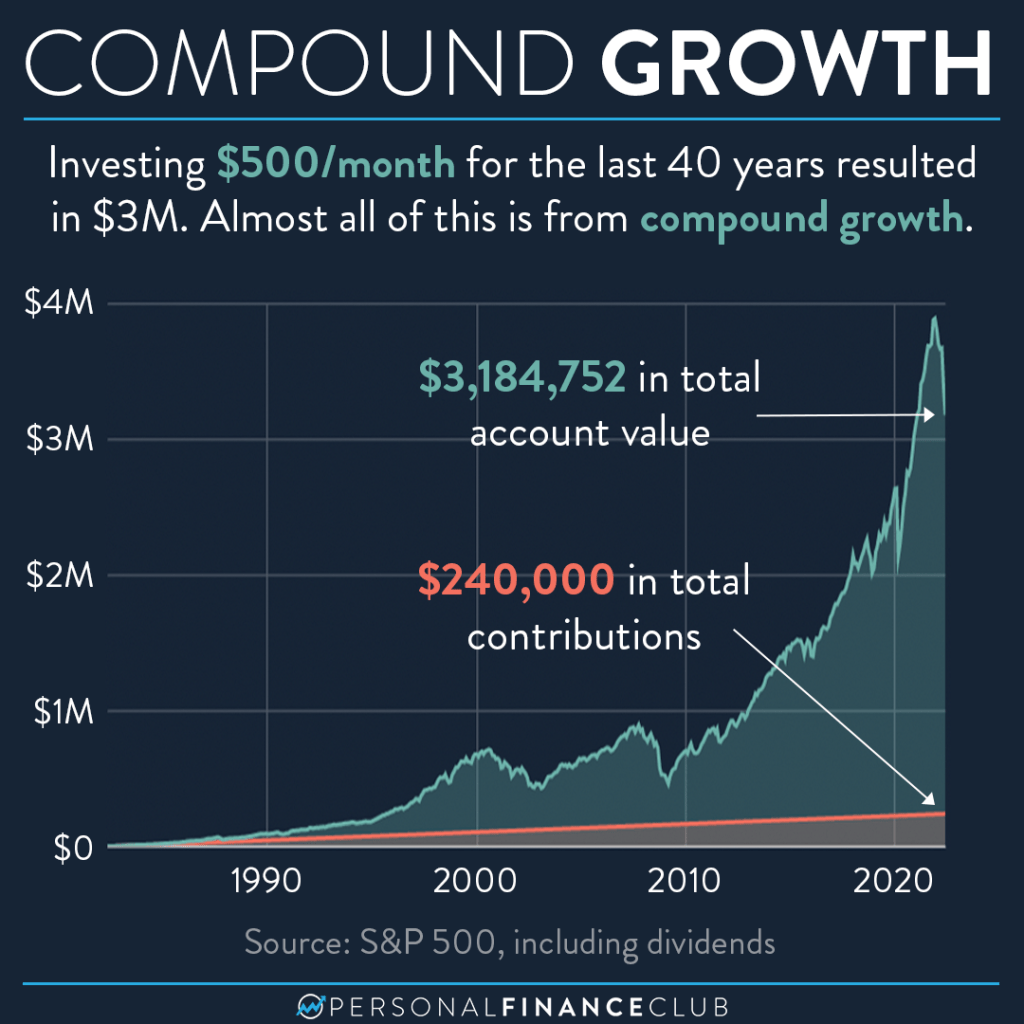

I learned about compound growth while learning about investing as well. I will let the experts below do the speaking, but for a beginner like me, I think Investopedia described it best as “…the process in which an asset’s earnings, from either capital gains or interest, are reinvested to generate additional earnings over time.”

Here are other resources you can read to learn more for yourself:

- Compounding Interest: Formulas and Examples (investopedia.com)

- Schwab MoneyWise: Benefits of Compound Growth

- Compound Annual Growth Rate: What Is CAGR? (investopedia.com)

- What Is Compound Annual Growth Rate and How To Calculate It | Entrepreneur | Entrepreneur

- What Is Compound Annual Growth Rate (CAGR)? – Forage (theforage.com)

For visual learners like myself, Personal Finance Club draws and shows what compound growth looks like over the years with a stable investment. Be mindful that he puts $500 as the contribution monthly, which is why the resulted compound growth is so high.

If you want to try testing out what your investment can grow with smaller monthly investment, then you can try NerdWallet’s compound growth calculator. You can learn more about estimated rate of returns here.

11. My Readings

So that is how I got started into investing. Since then, I have also started investing in real estate through Fundrise, which I can talk about in future postings if interested, and created a regular joint investment account with Charles and Schwab with my partner and we both contribute to it (since TD Ameritrade has now transferred over to Charles and Schwab), and will also be starting my own investment account this month also (not retirement).

However, it is scary to start as a beginner, I can say that for sure since I am still a beginner. I am continually reading to know more, and below are some books that I researched around and found great reviews for them from more experienced investors. These are books I personally have that have helped me a great deal.

I hope they can help you as well, they are from Amazon links, and I may make a small commission at NO cost to you if you buy it with the links below within 24 hours of clicking on it. I hope they help you get started also in investing whether you are younger or older.

- The Only Investment Guide You’ll Ever Need by Andrew Tobias

- How Much Money Do I Need to Retire? Uncommon Financial Planning Wisdom for a Stress-Free Retirement by Todd Tresidder

- The Psychology of Money by Morgan Housel

- The Intelligent Investor by Benjamin Graham

- The Early Investor: How Teens & Young Adults Can Become Wealthy by Michael W. Zisa

12. The Future

I look forward to updating and sharing my journey of beginner investor with everyone. Next investment update, will probably be at the start of 2024, and see how everything has come along.

Leave a comment